$1 Billion Proposed Public Offering of Common Stock and Pre-Funded Warrants Supporting Innovative Pneumococcal Vaccines

Vaxcyte, Inc. today announced that it has commenced an underwritten public offering of $1.0 billion of its common stock and pre-funded warrants.

As of August 3, 2024, Vaxcyte intends to grant the funding underwriters a 30-day option to purchase up to an additional $150 million of shares of its common stock offered in the public offering (including shares underlying the pre-funded warrants).

Vaxcyrte confirmed this offering is subject to market and other conditions, and there can be no assurance as to whether or when the offering may be completed or as to the actual size or terms of the offering.

The Company is developing broad-spectrum conjugate and novel protein vaccines to prevent or treat bacterial infectious diseases.

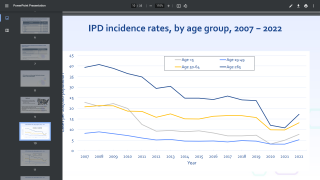

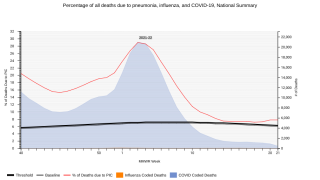

VAX-31 is a Phase 3-ready 31-valent, carrier-sparing pneumococcal conjugate vaccine (PCV) candidate being developed for the prevention of invasive pneumococcal disease (IPD) in adults and infants and is the broadest-spectrum PCV candidate in the clinic today.

VAX-24, the Company’s 24-valent PCV candidate, is designed to cover more serotypes than any infant PCV on-market and is currently being evaluated in a Phase 2 infant study.

Both VAX-31 and VAX-24 are designed to improve upon the standard-of-care PCVs by covering the serotypes in circulation that are responsible for a significant portion of IPD and are associated with high case-fatality rates, antibiotic resistance, and meningitis while maintaining coverage of previously circulating strains that are currently contained through continued vaccination practice.

Our Trust Standards: Medical Advisory Committee